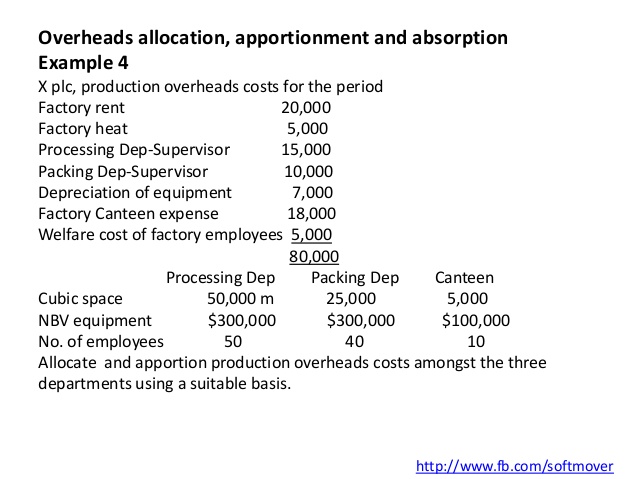

Under different costing system, product cost is also different, as in absorption costing both fixed cost and variable cost are considered as Product Cost. On the other hand, in Marginal Costing only the variable cost is regarded as product cost. An example of such cost is the cost of material, labour, and overheads employed in manufacturing a table. Period costs are the expenses in a business that aren’t directly linked to making specific products or services. Instead, they’re more about keeping the business running smoothly and supporting its overall operation.

Thus, it is fair to say that product costs are the inventoriable manufacturing costs, and period costs are the nonmanufacturing costs that should be expensed within the period incurred. This distinction is important, as it paves the way for relating to the financial statements of a product producing company. And, the relationship between these costs can vary considerably based upon the product produced. They are the costs that are directly and indirectly related to producing an item. This means that these costs directly impact the income statement for the specific time frame.

Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer. That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser. Take your learning and productivity to the next level with our Premium Templates.

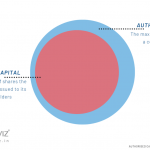

This additional information is needed when calculating the break even sales level of a business. It is also useful for determining the minimum price at which a product can be sold while still generating a profit. Production Accounting gives an insight into the cost of goods manufactured for your products, so that you can control the manufacturing costs during the production process. A soft drink manufacturer might spend very little on producing the product, but a lot on selling. Conversely, a steel mill may have high inventory costs, but low selling expenses. When inventory is purchased, it constitutes an asset on the balance sheet (i.e., “inventory”).

- CFI is on a mission to enable anyone to be a great financial analyst and have a great career path.

- These unsold units would continue to be treated as asset until they are sold in a following year and their cost transferred from inventory account to cost of goods sold account.

- If you are manufacturing your products in a repetitive manufacturing (REM) environment, you always use Product Cost by Period.

- These are incurred whether the business manufactures or acquires goods and are considered indirect costs of production.

- Period costs are not attached to products and the company does not need to wait for the sale of its products to recognize them as expense on income statement.

Product costs, also known as direct costs or inventoriable costs, are directly related to production output and are used to calculate the cost of goods sold. Direct material costs are the costs of raw materials or parts that go directly into producing products. For example, if Company A is a toy manufacturer, an example of a direct material cost would be the plastic used to make the toys.

Synder Unveils AI Dashboards: Natural Language Reports for Real-Time Retail & SaaS Financial Insights

People often confuse product and period costs due to the complexity of accounting terminology and the different ways these costs are treated in financial reporting. One unique aspect of product costs is their treatment as assets until the product is sold. product versus period costs Instead of being immediately expensed, product costs are capitalized, meaning they are recorded on the balance sheet as an asset.

Most of the components of a manufactured item will be raw materials that, when received, are recorded as inventory on the balance sheet. Only when they are used to produce and sell goods are they moved to cost of goods sold, which is located on the income statement. When the product is manufactured and then sold a corresponding amount from the inventory account will be moved to the income statement. So if you sell a widget for $20 that had $10 worth of raw materials, you would record the sale as a credit (increasing) to sales and a debit (increasing) either cash or accounts receivable. The $10 direct materials would be a debit to cost of goods sold (increasing) and a credit to inventory (decreasing).

The difference between product costs and period costs

Rather than being listed as inventory, period costs are listed as expenses for each accounting period. The product costs are sometime named as inventoriable costs because they are initially assigned to inventory and expensed only when the inventory is sold and revenue flows into the business. Product costs (direct materials, direct labor and overhead) are not expensed until the item is sold when the product costs are recorded as cost of goods sold. Period costs are selling and administrative expenses, not related to creating a product, that are shown in the income statement in the period in which they are incurred. Period costs include selling expenses and administrative expenses that are unrelated to the production process in a manufacturing business.

Comparing Product Costs and Period Costs

Period costs are costs that cannot be capitalized on a company’s balance sheet. In other words, they are expensed in the period incurred and appear on the income statement. The costs incurred from logistical transactions on the production version such as goods issues, confirmations, and goods receipts are updated directly on the PCC.

Explaining the Product Cost by Period Approach

- The simple difference between the two is that Product Cost is a part of Cost of Production (COP) because it can be attributable to the products.

- It’s like finding the right balance to make good products and keep the entire business in good shape.

- A business can go through periods where it doesn’t have any product costs, but there will still be period costs as these are unrelated to the ebb and flow of production.

- The classification of costs as product or period affects how they are reported in financial statements.

- On the other hand, in Marginal Costing only the variable cost is regarded as product cost.

- So if you pay for two years of liability insurance, it wouldn’t be good to claim all of that expense in the period the bill was paid.

This depends on whether the labor is directly related to production or not – a factory worker’s wages would be product costs, while a company secretary’s wages would be period costs. A business can go through periods where it doesn’t have any product costs, but there will still be period costs as these are unrelated to the ebb and flow of production. Instead, they’re related to the passing of time and any time-based expenses like utility bills and rent. Administrative expenses are non-manufacturing costs that include the costs of top administrative functions and various staff departments such as accounting, data processing, and personnel.

Examples of period costs are general and administrative expenses, such as rent, office depreciation, office supplies, and utilities. In general, overhead refers to all costs of making the product or providing the service except those classified as direct materials or direct labor. Manufacturing overhead costs are manufacturing costs that must be incurred but that cannot or will not be traced directly to specific units produced. In addition to indirect materials and indirect labor, manufacturing overhead includes depreciation and maintenance on machines and factory utility costs.

Product Cost by Period enables periodic analysis of costs at the product level. It enables you to collect costs at the product level independently of the production type. By mastering the principles of cost classification, businesses can gain deeper insights into their financial health and make informed decisions that drive long-term success. Today, we’re breaking down these two concepts to understand their general aspects, relationship with financial statements, and overall impact on business decision-making.

They’re often broken down into subcategories of fixed and variable costs, which can be used for calculating things like the break-even point. When a company sells its products, the product costs form part of the cost of goods sold (COGS) on the income statement. Firms account for some labor costs (for example, wages of materials handlers, custodial workers, and supervisors) as indirect labor because the expense of tracing these costs to products would be too great.

Once sold, these costs are transferred to the cost of goods sold (COGS) on the income statement. Based on the association with the product, cost can be classified as product cost and period cost. Product Cost is the cost that is attributable to the product, i.e. the cost which is traceable to the product and is a part of inventory values. On the contrary, Period Cost is just opposite to product cost, as they are not related to production, they cannot be apportioned to the product, as it is charged to the period in which they arise. Let’s say you’re considering hiring more staff to handle the increasing number of orders. By looking at period costs, you can evaluate the impact of such decisions on the bakery’s overall financial health.

Some expenses, such as utility bills, may have components that qualify as both product and period costs, requiring allocation. Many employees receive fringe benefits paid for by employers, such as payroll taxes, pension costs, and paid vacations. These fringe benefit costs can significantly increase the direct labor hourly wage rate. Other companies include fringe benefit costs in overhead if they can be traced to the product only with great difficulty and effort. Balancing product and period costs is important for your business performance efficiency. Product costs help you fine-tune the price of each item you sell, ensuring profitability.

Businesses must accurately classify these costs to determine taxable income. As a general rule, costs are recognized as expenses on the income statement in the period that the benefit was derived from the cost. So if you pay for two years of liability insurance, it wouldn’t be good to claim all of that expense in the period the bill was paid. Since the expense covers a two year period, it should be recognized over both years. Period costs describe a business’s additional costs incurred during a specific reporting period. While they still form part of the overall cost of running a business, they aren’t directly related to manufacturing a specific good or service.

The key difference between product cost and period cost is that product concurs when a company produces any products. Consequently, they are not apportioned to any product but charged as an expense in the income statement. According to the Matching Principle, all expenses are matched with the revenue of a particular period. So, if the revenues are recognised for an accounting period, then the expenses are also taken into consideration irrespective of the actual movement of cash.